malaysia company tax rate 2019

Discover why PitchBook is the only tool you need for your next private company valuation. Malaysia Personal Income Tax Rate.

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

For year of assessment 2022 only a special one-off tax will be imposed on companies excluding companies which enjoy the 17 reduced tax rate above which have.

. Companies that are about to establish their presence in Malaysia are allowed to apply for 0 to 5 tax rates based on the investments and commitments to job-creation. 22 October 2019. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia.

The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Korean summary of investment and tax information prepared and developed by Deloitte Malaysia. Company with paid up capital more than RM25 million. For Sales Tax goods other than petroleum products which are.

Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2 percent. Discover why PitchBook is the only tool you need for your next private company valuation. Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience With.

The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. The maximum rate was 30 and minimum was 24. The standard Malaysia corporate tax rate is of 24 for the financial.

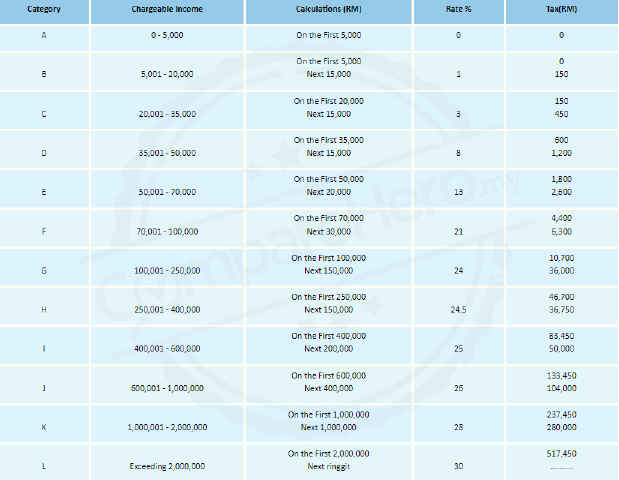

On the First 10000 Next 10000. On the First 5000 Next 5000. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

Company with paid up capital not more than RM25 million On first RM500000. Ad Get more accurate data for financial models build and analyze comps quickly. Rate TaxRM 0 - 2500.

The standard corporate income tax rate in Malaysia is 24. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a. Malaysia has one of the lowest corporate tax rate of 24 attracting many businesses and entrepreneurs to set up a company in the country.

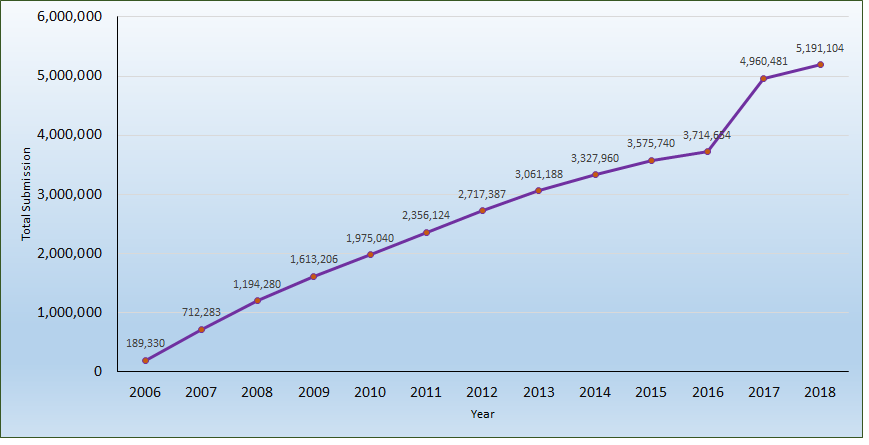

Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching. 0 to 5 Tax Rates for Incoming Companies Companies that are about to establish their presence in Malaysia are allowed to apply for 0 to 5 tax rates based on the. Data published Yearly by Inland Revenue Board.

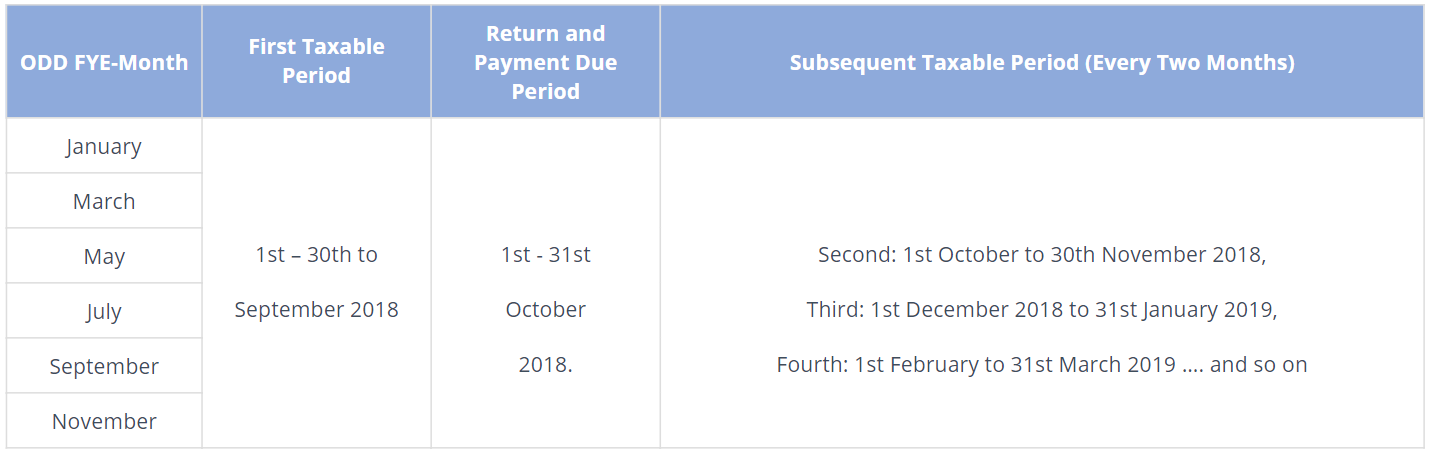

Here are the income tax rates for personal income tax in Malaysia for YA 2019. Change In Accounting Period. Based on this amount the income tax to pay the.

Here is a checklist of documents required to. What supplies are liable to the standard rate. For example lets say your annual taxable income is RM48000.

13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021. Small and medium companies are subject to a 17 tax rate with.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50. Income tax rates. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here.

Corporate tax is governed under the Income Tax Act 1967 which applies to all companies registered in Malaysia for chargeable income derived from Malaysia including. 10 percent for Sales Tax and 6 percent for Service Tax. Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020.

On the First 2500. A double deduction is also granted for the employment of ex-convicts. Ad Get more accurate data for financial models build and analyze comps quickly.

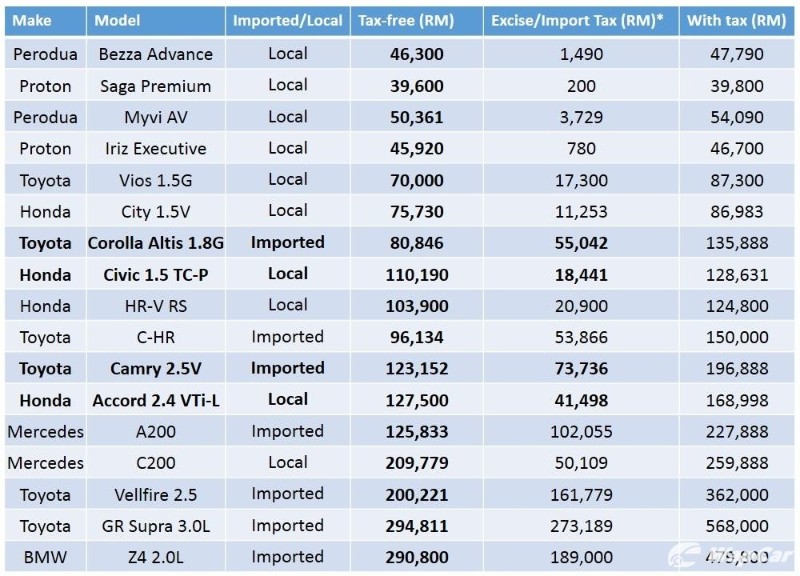

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Individual Income Tax In Malaysia For Expatriates

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

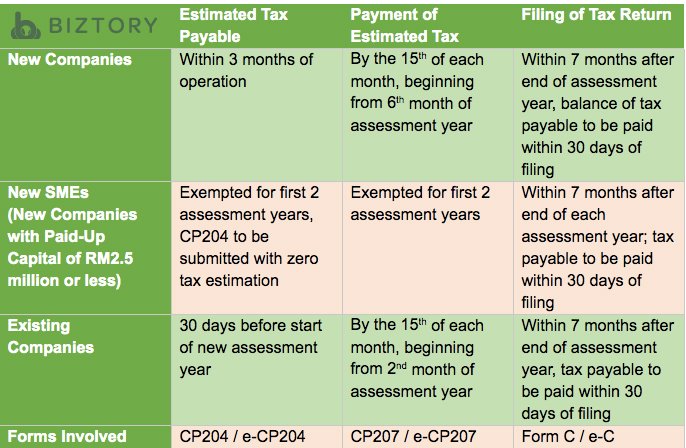

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Benefits In Kind Bik In Malaysia Hills Cheryl

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

Malaysia Sst Sales And Service Tax A Complete Guide

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Cukai Pendapatan How To File Income Tax In Malaysia

Income Tax Malaysia 2018 Mypf My

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Everything You Need To Know About Running Payroll In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com Investing Property Investor Investment Property

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Budget 2022 These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

0 Response to "malaysia company tax rate 2019"

Post a Comment