option greeks pdf

How Time Volatility and Other Pricing Factors Drive Profits pdf free book embodies the meaning of the name. In a sense the title of the Trading Options Greeks.

Trading Option Greeks By Dan Passarelli Pdf Download Read

The Delta of out-of-the-money put options will.

. The different Greeks are. The measures are considered essential by many investors for making informed decisions in options trading. How Time Volatility and Other Pricing Factors Drive Profits is an amazing advertising book.

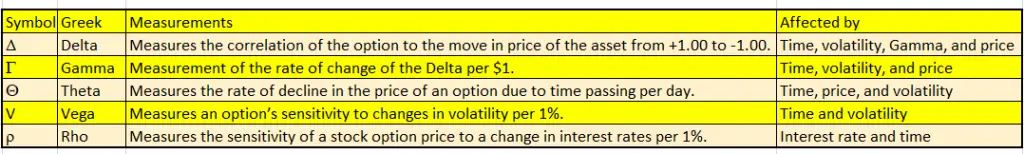

THE GREEKS In order to construct the approximate replicating portfolio we have to know by how much the value. Will cause changes in option values. The price of underlying Gamma 2 nd derivative of price Vega volatility Theta time Rho.

However there are many other option Greeks that. Introduction Options are instruments whose values are affected by many factors. It is defined as the rate of change of the option price with respect to the price of the underlying asset.

Here is an Option Greeks cheat sheet you can use as a quick reference guide. If we assume that volatility can change δt. GAMMA The options vega is a measure of the impact of changes in the underlying volatility on the option price.

We want to look at the option prices dynamically. 71 76 Vega Vega measures the sensitivity of the option price with respect to the volatility of the underlying asset. Greeks are dynamic and constantly changing.

The Greeks can help you examine your exposure to various options centric risks. Ey are the key to options risk management. THE BASICS OF OPTION GREEKS CHAPTER 1 The Basics 3 Contractual Rights and Obligations 3 ETFs Indexes and HOLDRs 9 Strategies and At-Expiration Diagrams 10 CHAPTER 2 Greek Philosophy 23 Price vs.

Option pricing models value options taking as given information about these factors at a point in time. Put options have a negative Delta that can range from 000 to 100. Read Section 123 from McDonald.

Greeks can help you plan your trades to take advantage of or avoidminimize the effects of these risks. OPTION GREEKS FOR PROFIT TABLE OF CONTENTS Option Fundamentals 9 Calls 10 Puts 11 Call and Put Variables 12 Strike Price 13 Expiration 13 Interest Rates Rho 15 Volatility Vega 15 Decay Theta 16 Intrinsic Value 17 Settlement 18 Put Option Analogy 19. Specifically the vega of an option expresses the change in the price of the option for every 1 change in underlying.

For those not familiar with option pricing it can also be an educational guide as well. Nevertheless you can no longer easily find Trading Options Greeks. Since volatilities change over a certain time period the option premium of both call.

The Delta of ITM put options will get closer to 100 as expiration approaches. It is the slope of the curve that relates the option price to the underlying asset. Trading Options Greeks.

Trading Option Greeks written by Dan Passarelli and has been published by John Wiley and Sons this book supported file pdf txt epub kindle and other format this book has been release on 2010-05-13 with Business Economics categories. Then we can see what happens in the contexts of the pricing models we use. Greeks can help.

Delta Gamma Theta Vega and Rho. If you are interested in a deeper dive into options trading my Options 101. For the sake of simplicity the examples that follow do not take into consideration commissions and other transaction fees tax considerations or margin requirements which are factors that may significantly affect the economic consequences of a.

When terms of orders higher than are ignored. Or out of the money. Veteran options trader Dan Passarelli explains a new methodology for option trading and valuation.

As time passes changes in the values of these factors price of the underlying time-to-maturity volatility. Dan Passarelli - Trading Option Greekspdf - Free ebook download as PDF File pdf Text File txt or read book online for free. The delta varies between 0 and 1 for a call option and -1 to 0 for a put option.

Delta Gamma Vega Theta and Rho are the key option Greeks. The Delta will decrease and approach 100 as the option gets deeper ITM. The five Greeks that this study will focus on are D elta first derivative of.

Download View Dan Passarelli - Trading Option Greekspdf as PDF for free. What happens with the option price if one of the inputs parameters changes. At-the-money options usually have a Delta near 050.

Scribd is the worlds largest social reading and publishing site. For more about option Greeks check out my article- Option Greeks Explained. How Traders Use Option-Pricing Models 24 Delta 25 Gamma 32 Theta 38 Vega 42 Rho 46 Where to Find Option Greeks 51 Caveats with Regard.

Options that are very deeply into or out of the money have Γ gamma values close to 0. First we give names to these effects of perturbations of parameters to the option price. Suppose you have a portfolio of options Assume it has options one one stock S and that volatility for all the options is σ dΠ Π y δs Π s δt 1 2 2Π s2 δs2 1 2 2Π t2 δt2 2Π st δsδt.

Sensitivity Analysis aims to quantify the impact of a. The Greeks are utilized in the analysis of an options portfolio and in sensitivity analysis of an option or portfolio of options. Options are to the particular risk source one should look at the Greeks options Hull 2002 - quanti-ties denoted by Greek letters representing options sensitivities to risk.

Vega can be termed as the first derivative of an option price with respect to the volatility of the underlying asset. Vega is not a Greek letter the Greek letter nu ν is used instead.

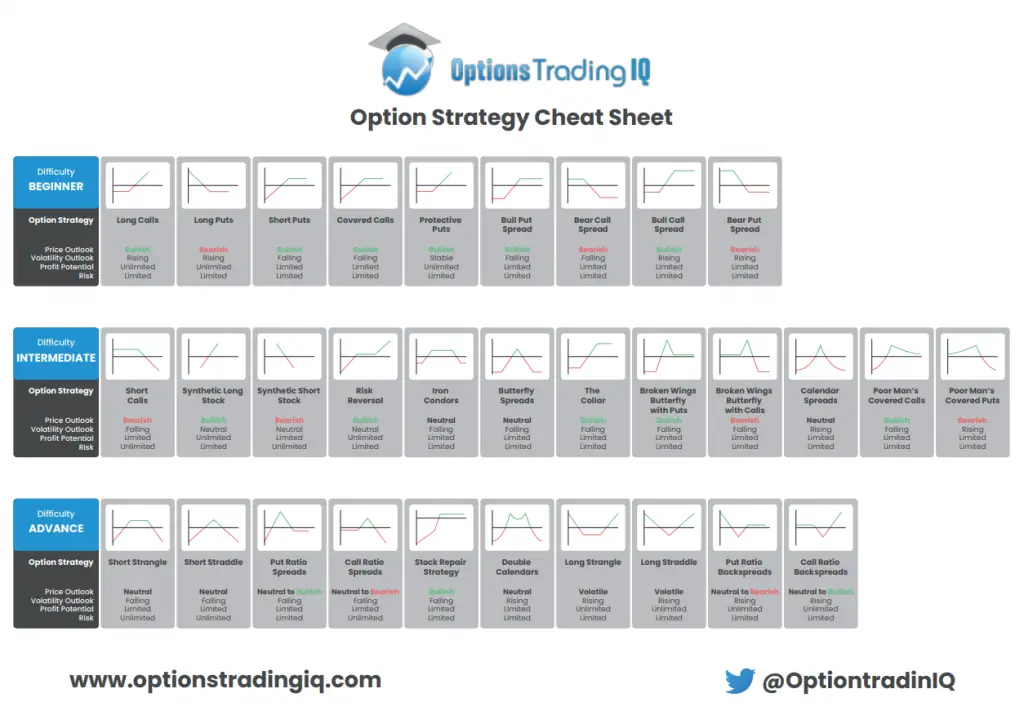

Option Strategy Cheat Sheet Pdf Greeks Finance Financial Economics

Pdf Hedging Option Greeks Risk Management Tool For Portfolio Of Futures And Option

Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits 2nd Edition Wiley

Option Strategies Cheat Sheet New Trader U

Pdf Trading Option Greeks Download Book Online

Option Greeks Strategies Backtesting In Python By Anjana Gupta

Dan Passarelli Trading Option Greeks Pages 1 50 Flip Pdf Download Fliphtml5

Option Greeks Made Easy Delta Gamma Theta Vega Ep 199 Tradersfly

Pdf On Volatility Trading Option Greeks Publishing India Group Academia Edu

Read Pdf Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits Bloomberg Financial Book 159 R A R

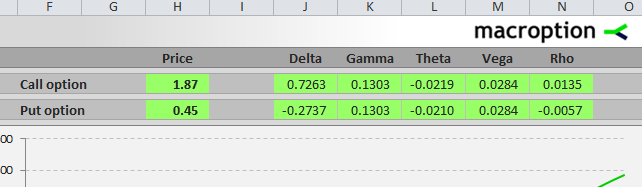

Option Greeks Excel Formulas Macroption

Option Greeks Cheat Sheet New Trader U

Trading Option Greeks How Time Volatility And Other Pricing Factors Drive Profit Wiley

Download Pdf Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits By Dan Passarelli Online New Chapters Twitter

Option Greeks February 8 2016 By Thomas Mann All Things Stocks Medium

Options Pricing Option Greeks Explained Trade Options With Me

Dan Passarelli Trading Option Greeks Pdf

Pdf Trading Options Greeks By Dan Passarelli Ebook Perlego

0 Response to "option greeks pdf"

Post a Comment